Cumulative Imbalances

See the Imbalance Battle. As a Single Line.

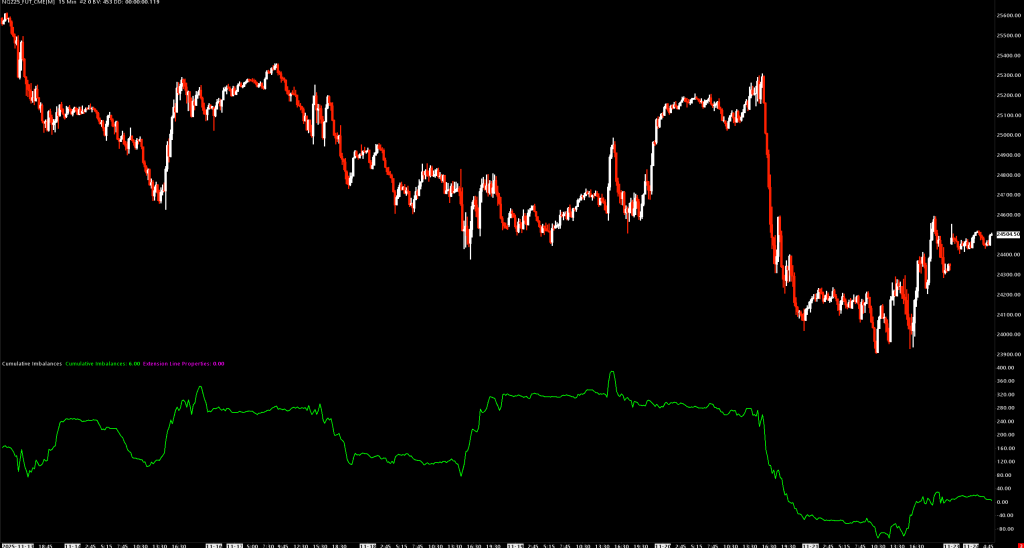

Volume imbalance indicators show you where buyers or sellers dominated. But they don’t show you who’s winning overall.

Cumulative Imbalances tracks the running score:

- Buy imbalance detected → Line goes UP (+1)

- Sell imbalance detected → Line goes DOWN (-1)

Watch the cumulative total build over time. See trends, divergences, and shifts in control—all from one clean line.

WHAT IT SHOWS:

- Rising line = Buyers winning the imbalance war

- Falling line = Sellers winning

- Divergence from price = Potential reversal signal

KEY FEATURES:

- All 9 comparison methods from VAP Threshold Alert

- Minimum volume filter for ratio comparisons (no noise)

- Separate pane display for clean analysis

- Stacked imbalance highlighting (optional)

- Extension lines for key levels (optional)

TRADING APPLICATIONS:

- Trend confirmation (trade with the line direction)

- Divergence setups (price vs cumulative disagreement)

- Session bias analysis (who’s in control today?)

- Absorption detection (sharp moves = strong hands)

PERFECT FOR:

- Orderflow traders who want cumulative context

- Divergence hunters looking for reversal signals

- Trend traders confirming directional bias

- Anyone who wants imbalance data simplified

One line. Complete picture.

Documentation

Tracks the running total of bid/ask imbalances as a line graph, showing the cumulative buying vs selling pressure over time.

Cumulative Imbalances extends the Volume At Price Threshold Alert concept by maintaining a running count of imbalances:

- When a buying imbalance is detected (ask dominance), the line moves up (+1)

- When a selling imbalance is detected (bid dominance), the line moves down (-1)

This creates a cumulative delta-style indicator specifically for imbalance events, helping you visualize whether buyers or sellers are winning the imbalance battle over time.

How It Works

- Scans each bar’s Volume at Price data

- Identifies price levels meeting your imbalance threshold

- Adds +1 for buy imbalances, -1 for sell imbalances

- Plots the cumulative total as a line graph

Key Differences from Volume At Price Threshold Alert

| Feature | VAP Threshold Alert | Cumulative Imbalances |

|---|---|---|

| Display | Markers on price chart | Line graph in separate pane |

| Output | Individual alert locations | Running total over time |

| Direction | Shows where imbalances occur | Shows net buying/selling pressure |

| Trend Analysis | Difficult | Easy – line direction shows bias |

Subgraphs

| Subgraph | Description |

|---|---|

| Cumulative Imbalances | Main line graph showing running imbalance total |

| Count of Alerts | Number of imbalances per bar (hidden by default) |

| Trigger 1-47 | Individual trigger price levels (hidden by default) |

| Adjacent Alert Highlights | For stacked imbalance highlighting |

Inputs

| Input | Default | Description |

|---|---|---|

| Comparison Method | Total Volume | Method for detecting imbalances (see below) |

| Volume Threshold | 100 | Threshold for volume-based comparisons |

| Percentage Threshold | 150% | Threshold for ratio-based comparisons |

| Minimum Volume for Ratio Comparisons | 0 | Filter out low-volume ratio signals |

| Volume Alert Number | 0 | Audio alert sound |

| Draw Extension Lines | None | Extension line options |

| Highlight Adjacent Alerts Group Size | 0 | Minimum size for stacked imbalance highlighting |

| Number of Days to Calculate | 30 | Lookback period |

Comparison Methods

- Bid Volume – Count when bid volume exceeds threshold (+1)

- Ask Volume – Count when ask volume exceeds threshold (+1)

- Total Volume – Count when total volume exceeds threshold (+1)

- Number of Trades – Count when trade count exceeds threshold (+1)

- Ask Volume Bid Volume Difference – +1 for ask dominance, -1 for bid dominance

- Ask Volume Bid Volume Diagonal Difference – Diagonal version with direction

- Ask Volume Bid Volume Ratio – +1 for ask ratio, -1 for bid ratio

- Ask Volume Bid Volume Diagonal Ratio – Diagonal ratio with direction

- Bid Volume and Ask Volume Separately – Both thresholds must be met (+1)

Interpreting the Line

Trend Direction

- Rising line: Net buying pressure (more buy imbalances)

- Falling line: Net selling pressure (more sell imbalances)

- Flat line: Balanced or no significant imbalances

Divergences

- Price up + Line down: Bearish divergence (selling into strength)

- Price down + Line up: Bullish divergence (buying into weakness)

Extreme Readings

- Sharp spikes up: Strong buying absorption

- Sharp spikes down: Strong selling absorption

Use Cases

Trend Confirmation

Align trades with the cumulative line direction:

- Long setups when line is rising

- Short setups when line is falling

Divergence Trading

Look for price/cumulative divergences at key levels for reversal setups.

Session Analysis

Reset at session start to see intraday cumulative bias.

Installation

- Place

CumulativeImbalances.dllin your Sierra ChartDatafolder - Add study to chart: Analysis > Studies > Add Custom Study

- Search for “Cumulative Imbalances”

Requirements

- Sierra Chart with Volume at Price data enabled

- Main chart must have VAP data (study displays in separate pane)