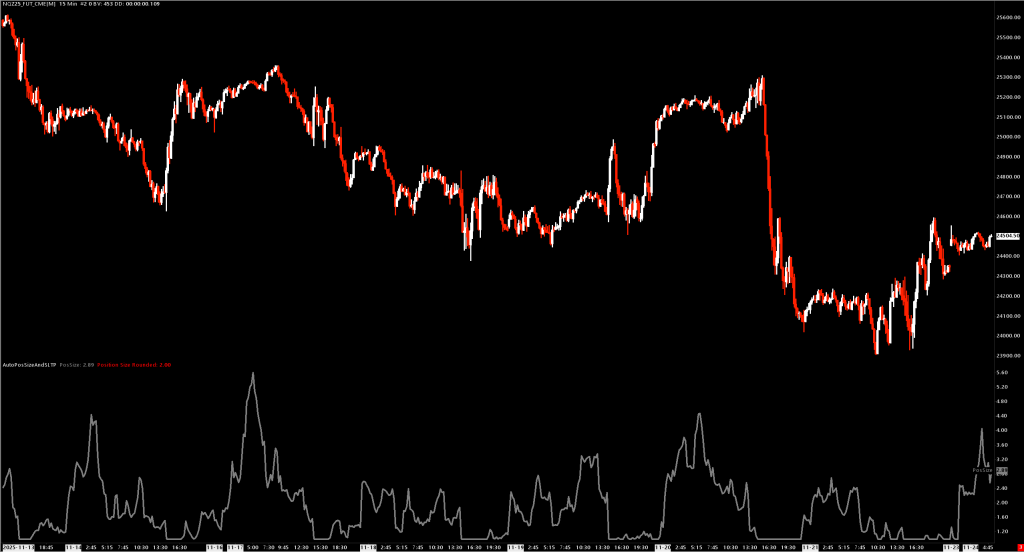

AutoPosSizeAndSLTP

Position Sizing + Order Entry + Risk Management. One Study.

Stop guessing position sizes. Stop calculating tick distances for your stops. Stop manually moving stops to breakeven.

AutoPosSizeAndSLTP handles it all:

VOLATILITY-BASED POSITION SIZING

- Automatically calculates position size based on ATR

- High volatility = smaller size, Low volatility = larger size

- Volume-weighted ATR option for more responsive sizing

- Respects your min/max position limits

DOLLAR-BASED RISK MANAGEMENT

- Set stop loss in dollars, not ticks ($50 max loss)

- Set profit target in dollars ($100 target)

- Study calculates exact tick distances automatically

- Risk stays consistent regardless of volatility

ONE-KEY ORDER ENTRY

- Customizable keyboard shortcuts (B=Buy, S=Sell, etc.)

- Market and limit orders with automatic brackets

- Scale-in and scale-out support built-in

- Cancel opening orders while preserving stops/targets

AUTOMATIC BREAKEVEN

- Stop moves to breakeven when target % reached

- Configurable trigger percentage and offset

- “Move Target to Breakeven” for quick profit lock

PERFECT FOR:

- Discretionary traders who want consistent position sizing

- Scalpers who need fast keyboard-driven execution

- Risk-focused traders managing dollar-based stops

- Anyone tired of calculating position sizes manually

One study. Complete execution system.

Documentation

Automatic position sizing with integrated order entry, stop-loss, profit targets, and breakeven management.

Overview

AutoPosSizeAndSLTP calculates optimal position size based on market volatility (ATR) and provides one-click/one-key order entry with automatic bracket orders. Think of it as a complete trading execution system that:

- Sizes positions based on current volatility

- Sets stops and targets in dollar amounts (not ticks)

- Manages risk with automatic breakeven moves

- Executes trades via menu or keyboard shortcuts

Key Features

Volatility-Based Position Sizing

- Uses Average True Range (standard or volume-weighted)

- Higher volatility = smaller position size

- Lower volatility = larger position size

- Respects min/max position limits

Dollar-Based Risk Management

- Set stop loss as a dollar amount (e.g., $50 max loss)

- Set profit target as a dollar amount (e.g., $100 target)

- Study automatically calculates tick distances based on position size

Integrated Order Entry

- Market orders (Buy/Sell)

- Limit orders at pointer price

- All orders include automatic stop and target brackets

- Scale-in and scale-out support

Breakeven Management

- Automatic stop move to breakeven when target % reached

- Configurable breakeven trigger percentage

- Offset to cover fees/commissions

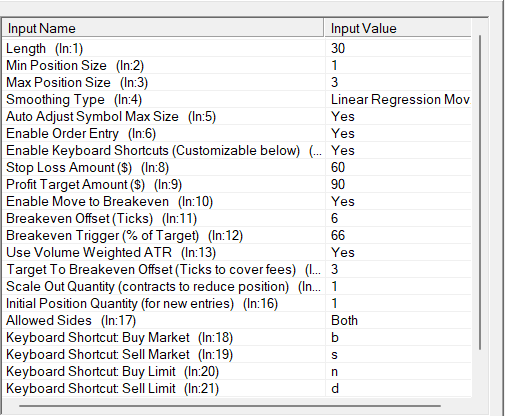

Inputs

Position Sizing

| Input | Default | Description |

|---|---|---|

| Length | 60 | ATR lookback period |

| Min Position Size | 1 | Minimum contracts |

| Max Position Size | 3 | Maximum contracts |

| Smoothing Type | Wilder’s | Moving average type for ATR |

| Use Volume Weighted ATR | Yes | Weight ATR by volume for more responsive sizing |

| Auto Adjust Symbol Max Size | Yes | Automatically update Sierra Chart’s symbol max position |

Risk Management

| Input | Default | Description |

|---|---|---|

| Stop Loss Amount ($) | $50 | Maximum dollar loss per trade |

| Profit Target Amount ($) | $100 | Target dollar profit per trade |

| Enable Move to Breakeven | Yes | Auto-move stop to breakeven |

| Breakeven Trigger (% of Target) | 50% | Move stop when this % of target reached |

| Breakeven Offset (Ticks) | 6 | Ticks beyond entry for breakeven stop |

| Target To Breakeven Offset (Ticks) | 3 | Offset for “Move Target to Breakeven” function |

Order Entry

| Input | Default | Description |

|---|---|---|

| Enable Order Entry | Yes | Enable menu and keyboard order entry |

| Enable Keyboard Shortcuts | Yes | Enable hotkey trading |

| Initial Position Quantity | 1 | Contracts for new position entries |

| Scale Out Quantity | 1 | Contracts to reduce when scaling out |

| Allowed Sides | Both | Restrict to Long Only, Short Only, or Both |

Keyboard Shortcuts (Customizable)

| Action | Default Key |

|---|---|

| Buy Market | B |

| Sell Market | S |

| Buy Limit | N |

| Sell Limit | D |

| Cancel Opening Orders | C |

| Move Target to Breakeven | T |

How Position Sizing Works

The formula: Position Size = Max Size / (ATR / 10)

Example:

- Max Position Size: 3 contracts

- Current ATR: 15 ticks

- Calculation: 3 / (15/10) = 3 / 1.5 = 2 contracts

When volatility is high (large ATR), position size decreases. When volatility is low (small ATR), position size increases up to the maximum.

Order Types

New Position

- Uses Initial Position Quantity

- Attaches stop and target based on dollar amounts

- Enables breakeven management if configured

Scale-In (Adding to winning position)

- Checks remaining capacity vs max position

- Uses Initial Position Quantity (or remaining capacity if smaller)

- Attaches new brackets

Scale-Out (Reducing position)

- Uses Scale Out Quantity

- Reduces position without affecting existing stops/targets

Menu Commands

Right-click chart to access:

- Buy Market (Calc Size) – Market buy with calculated sizing

- Sell Market (Calc Size) – Market sell with calculated sizing

- Buy Limit at Pointer (Calc Size) – Limit buy at crosshair price

- Sell Limit at Pointer (Calc Size) – Limit sell at crosshair price

- Move Target to Breakeven – Move profit target to entry + offset

- Cancel Opening Orders – Cancel limit entries, keep stops/targets

Requirements

- Sierra Chart with Trade Mode enabled

- Chart Trade Mode must be active for order entry

- Works with simulation or live trading

Installation

- Place

AutoPosSizeAndSLTP.dllin your Sierra ChartDatafolder - Add study to chart: Analysis > Studies > Add Custom Study

- Search for “AutoPosSizeAndSLTP”

- Enable Chart Trade Mode for order entry functionality